About Hansen Indirect Tax

Hansen Indirect Tax specializes in providing comprehensive consulting services relating to various indirect taxes below.:

|

|

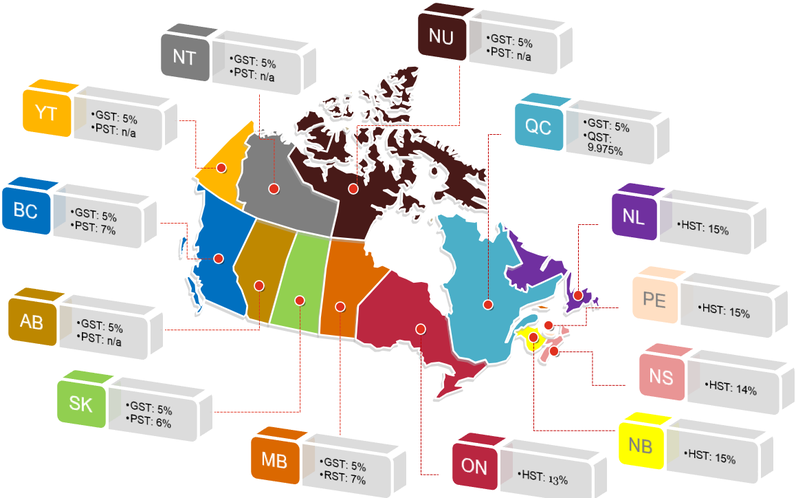

Canadian Indirect Tax Rates in 2025

Our Services

General Planning and Advice

We offer both verbal and written consulting services to help you understand and navigate the application of indirect taxes, particularly GST/HST and BC PST compliance and transition.

Audit Defence and Voluntary Disclosure

Our team assists in reducing or eliminating proposed government assessments for indirect taxes. We provide support in planning meetings with taxing authorities and preparing written responses. Additionally, we coordinate and deliver voluntary disclosure submissions to various taxing authorities, following up to eliminate audit exposure and minimize penalties and interest.

Transaction Support

We review proposed domestic and international transactions, identifying planning opportunities and potential risks. Our goal is to minimize indirect tax expenses by structuring transactions to maximize exemptions.

Sales Tax Recovery

We assist companies in identifying opportunities for indirect tax refunds and system improvements to reduce direct and administrative costs related to indirect taxes.

Training

We offer training on all aspects of indirect tax that is customized for your particular industry or specific need.

Online Training Packages - COMING SOON! Contact us for more info.